A recent study by the Small Business Administration has confirmed what we have been experiencing at our San Diego business loans division when talking to clients. That is, banks are giving out fewer loans to small businesses in San Diego. According to a recent SBA study, the number of small business loans dropped by another 5% ($45.3 billion) nationwide last year.

A recent study by the Small Business Administration has confirmed what we have been experiencing at our San Diego business loans division when talking to clients. That is, banks are giving out fewer loans to small businesses in San Diego. According to a recent SBA study, the number of small business loans dropped by another 5% ($45.3 billion) nationwide last year.

In addition to that, the Biz2Credit Small Business Lending Index reports that less than 15% of small business loans were approved by big banks. The banks most likely to reject your San Diego small business loan are reported as being Bank of America (BAC), Wells Fargo (WFC), JPMorgan Chase (JPM), PNC Bank (PNC), and TD Bank USA (TD).

It is hard times for California business owners seeking San Diego small business loans. Banking loan restrictions have left a serious void for San Diego entrepreneurs and business owners in need of temporary financing solutions.

The small business loan division of SDJB has stepped in to fill this void for hundreds of small business owners in San Diego and Southern California. We provide fast, no credit check, business loans upwards to $250,000 (and beyond).

With interest rates often less than a credit card advance, our San Diego small business loans have been a lifeline to many California business owners who need financing to launch a business or temporary funds to cover operating expenses.

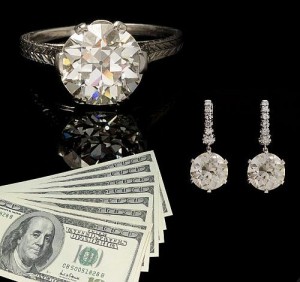

Call us at (619) 236-9603 today to talk with one of our collateral business loan specialists and arrange a free loan consultation. If you have luxury collateral like fine jewelry, gold, or silver, SDJB is how to get a San Diego small business loan in less than an hour.